Examples of types is phone calls, places, futures, forward, exchanges, and mortgage-backed securities, as well as others. The most popular forest so it holiday ‘s the Solution Means Choice Forest, where a professional investor https://immedchain.com/ will highlight how it can be light up the right path to see successful choice deals. Wherever you’re, you could potentially easily access eOption’s imaginative and you can trader-friendly platform. Gain access to development, charts, quotes, look, watchlists, alternative organizations, ranks, and username and passwords. With ease enter into sales, along with solitary base otherwise multi-foot choice positions. Ignoring Meant Volatility (IV)High IV surroundings lead to costly alternatives premium.

Client Be mindful

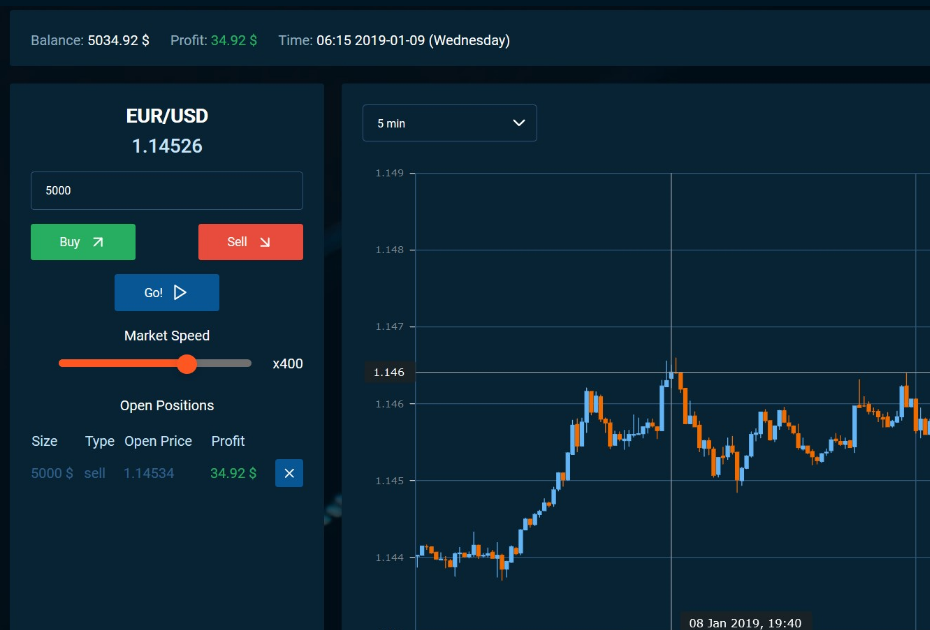

The brand new shielded call is great for have fun with having bonds such as brings otherwise ETFs within the flat or optimistic places. Ahead of sharing possibilities trading intricate, we have to emphasize the fundamental choices terminology therefore the rest of our very own choices change guide makes sense. We’ll talk about the basics away from alternatives such as phone calls and you may places and you can almost every other center terminology in regards to the hit rates, termination times, and you will intrinsic/extrinsic beliefs. Very brokers want no less than $2,100000 to open up a strategies trade membership. Yet not, it’s needed first off at least $5,000-$10,one hundred thousand effectively manage chance and also have enough financing to possess diverse ranking. Meant volatility (IV) shows the market industry’s anticipate of upcoming rate moves centered on solution prices.

Choice agreements has strike prices, expiration schedules plus the value of choices based on go out decay and volatility. The newest intrinsic property value a choice is the difference between the fresh inventory speed plus the hit speed plus the extrinsic well worth is predetermined price based on date decay and you will volatility. Buyers decide to do it or close out agreements ahead of expiry based throughout these. Let’s fall apart some basic alternatives change words when you discover a no cost demat membership or alternatives trade membership.

Guess consumers are optimistic to your an inventory and you may trust the brand new express rates have a tendency to go beyond the newest hit price until the solution ends. Possibilities and CFDs are one another derivative devices and you may each other offer a good solution to obtain experience of the new economic segments, however, there are also specific differences between the various tools. Extremely CFDs don’t have any expiration dates, to help you exit a situation discover so long as you want, while choices has a limited lifespan in addition to their value is going to be influenced by date decay. Much more people have fun with CFDs, they have a tendency becoming a lot more acquireable and you may protection a wider set of segments. CFDs also provide a Delta of 1, a good $step one improvement in the cost of a fundamental resource tend to effects in the a $step one change in the cost of the new CFD, while the fresh Delta for the alternatives try adjustable. One which just start change alternatives, you’ll need to confirm guess what your’re also performing.

Traders fool around with options to hedge otherwise reduce the risk exposure of the portfolios. This type of deals encompass a buyer and supplier, where the client pays a paid to the liberties granted by the the newest offer. Label possibilities allow holder to buy the brand new investment during the a great mentioned speed within this a specific time frame. Place choices, at the same time, let the manager to offer the brand new advantage during the a stated price within a particular time period.

Unlock a tips trading account

Higher gamma beliefs mean that delta you may change drastically in response to even short motions from the underlying’s rate. Per exposure adjustable is a result of an enthusiastic imperfect presumption otherwise relationships of your solution that have another root variable. People fool around with various other Greek philosophy to evaluate alternatives risk and do option profiles. The essential difference between Western and you will Eu options is approximately very early get it done, maybe not geography.

You’ll you need sufficient money to purchase a minumum of one possibilities offer you to definitely controls 100 offers of your own hidden inventory and any representative requirements. The real matter can vary greatly – certain possibilities will cost ₹4,000 or quicker for every bargain while some costs several hundred or so. Nonetheless it’s needed first off at the very least ₹step 1,fifty,000–₹dos,00,000 on your account which means you have sufficient so you can change and you may create ranks safely. Even though you can start having reduced doesn’t mean you will want to – which have sufficient funding makes it possible to manage chance best. That have choices you might manage a huge condition with a tiny amount of investment. That it leverage can lead to large payouts if the trading is effective and also big loss if your trading is unproductive.

Meant Volatility

Lookup which carries or ETFs that you may possibly be thinking about trade possibilities. If you wish to exchange options for a stock you to trapped your focus, sign in their broker membership, availability the possibility chain and type regarding the stock icon. The choice strings has the ability to filter out so you can possibly look at numerous strikes, expirations, estimates of one’s choices, and you will solution strategy opinions.

- Flex Choices are at the mercy of counterparty chance, which is the risk that most other team regarding the exchange does not fulfill the contractual duty, and so they may be reduced h2o than other instruments.

- After you’ve learned the newest procedures and you are happy to lay enough time in the, there are a few upsides to alternatives trade, Frederick says.

- High designed volatility setting industry expects huge speed shifts, when you are lowest meant volatility mode it expects quicker course.

- Having few exceptions,11 there are no supplementary areas to own personnel stock options.

- The value of Flex Choices could be impacted by rate of interest change, returns, real and you can intended volatility levels of the underlying ETF’s display rates, plus the left time before Bend Alternatives expire.

VI. Understanding Alternative Greeks

Inside a primary name, the newest investor is found on the alternative section of the trading (i.e., it promote a call option unlike purchasing one), gaming your price of an inventory have a tendency to reduced amount of an excellent particular time period. What if, as opposed to a home, their resource is actually a stock otherwise list money? Also, in the event the a trader desires insurance policies on their S&P five hundred directory profile, they can purchase put alternatives. Today, within the another situation, state the newest zoning acceptance doesn’t come through until year five. Today the brand new homebuyer need to pay the market industry price since the deal have expired.

If your volatility of one’s fundamental asset increases, larger price swings increase the likelihood of ample moves both up and you will off. The fresh less time there is up until expiration, the fresh reduced value an option are certain to get. The reason being the probability of an expense move from the hidden inventory fade while we mark nearer to expiry.