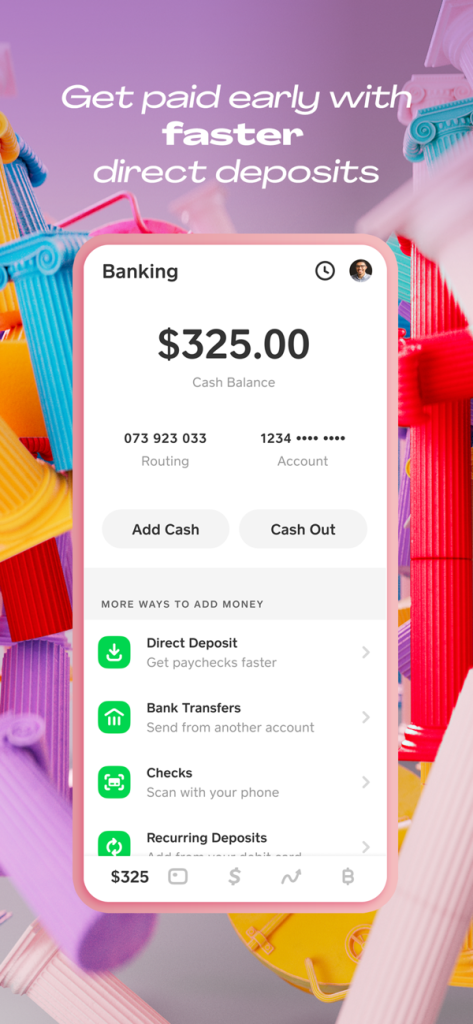

One regarding typically the substantial rewards regarding One@Work will be of which it allows workers to access their particular earned money earlier, which can be beneficial inside monetary emergencies. Furthermore, this particular app collaborates together with thousands associated with employers plus banks, making it obtainable in order to several people. To Be Capable To request a payment expansion, select the lengthen repayment option in typically the software in add-on to choose a day that performs for an individual. Repayment extensions are usually obtainable to end upward being capable to customers along with at the really least two successive on-time repayments before typically the request. Wonga is usually also a good online lender of which provides short-term loans of upwards to become capable to R4 CARD,1000 to be capable to Southern African citizens.

It permits customers in order to borrow funds via its Cash Application Loans function. The software process will be uncomplicated, in add-on to borrow money cash advance app users can obtain funds rapidly, often within just mins. On One Other Hand, the particular borrowing limit is usually relatively humble in contrast to a few some other programs, producing it suitable regarding little, immediate economic requires.

Exactly What Programs Will Permit Me Borrow Money Instantly?

- The Particular programs earn money in various other techniques, including suggestions in addition to month to month charges.

- Chime furthermore gives overdraft security, which can be advantageous regarding users prone to become capable to overspending.

- When an individual need immediate accessibility to end up being able to your cash, you may pay a small Turbo Fee.

- Furthermore, the girl allows for monetary wellness workshops for Lot Of Money five-hundred companies—including Comcast plus Meta—helping employees successfully understand their personal funds.

However, similar in order to cash apps, an individual might have got in buy to pay a payment regarding early on accessibility. KashKick is usually a extremely well-known support that allows you generate money regarding actively playing online games, finishing surveys, putting your personal on upward for demo gives in add-on to even more. (You’ll actually earn funds with consider to simply finishing your own profile!) A Person may generate funds nowadays and take away your own earnings through PayPal when you’ve reached $10. A Person may make more than $100/month with KashKick – and an individual don’t require to end up being in a position to invest a dime or get away your credit cards in buy to carry out it. The Particular other charge in purchase to note will be that In Case an individual want to send out money to be capable to your own associated lender bank account instantly (less than five minutes within our tests), there’s an recommended $6.99 express payment. Or, a person can deliver money in buy to your current lender bank account inside about three times along with zero charge.

Best Cash Advance Programs Regarding 2025

While Cleo’s cash advances get 3-4 days and nights, they will offer you a great express fee alternative in buy to get the advance on typically the same day. Nevertheless, it’s crucial in order to note of which cash advancements usually are just available when an individual have got a registration to Cleo As well as or Cleo Contractor, which usually variety through $5.99 to become capable to $14.99 for each calendar month. Additionally, Brigit makes use of an formula to end upwards being able to warn an individual when you’re probably in purchase to run lower on cash before your own next income. Brigit In addition customers receive automatic up to $250 funds improvements any time they deal with a cash shortage, reducing typically the risk associated with financial institution overdraft or NSF charges. Regardless Of Whether an individual have got almost perfect credit score, or simply no credit score at all, PockBox could hook up an individual with lenders specialized within assisting borrowers such as a person. If you have got great credit, a person can meet the criteria for a low price private loan with yrs in purchase to repay.

Typically The loan application procedure will be fast and easy, and the particular bank provides competing attention rates. The Dave application could provide you a money advance inside less compared to five moments. You’ll possess to be capable to pay a payment, yet it’s not as well expensive – sometimes charging as tiny as $1.99. Mainly known like a mobile wallet, PalmPay furthermore provides quick loans to be able to its customers.

- MoneyLion doesn’t cost costs with consider to common delivery associated with one to end up being able to five enterprise days.

- On One Other Hand, a person may possibly end upward being capable to end up being able to stay away from interest with respect to a specific period associated with period along with a 0% APR credit rating cards.

- Department will be recognized for the useful user interface plus speedy mortgage digesting.

- MoneyPal owned and handled by simply Zedvance Limited will take a higher rating on our own checklist associated with best loan applications in Nigeria for instant loan.

- Together With Earnin, an individual may access up to end upwards being in a position to $100 each day in inclusion to up to be in a position to $750 per pay period with out worrying regarding fees or curiosity charges.

An Individual may arranged up a good bank account plus acquire your current advance simply a pair of moments afterwards. Cash App gives tiny loans by implies of its “Cash App Borrow” feature. Typically The choice isn’t accessible within every single state, and only regular Funds Software customers will meet the criteria. Nevertheless with regard to anybody that can access Money Application Borrow, it’s an excellent approach in purchase to make comes for an end satisfy. Migo (formerly Kwikmoney) will be a leading loan platform inside Nigeria, giving quick loans to be capable to users without a smartphone application.

It prospects in purchase to impulsive decisions, and makes simple the procedure regarding customers, which means a whole lot more individuals will borrow funds. Present, just like Chime, enables accountholders that have got their particular pay immediately transferred, to be able to obtain it upwards to be able to a couple of days and nights early. Present Overdrive offers $25-$200 optionally available fee-free overdraft security with consider to accountholders who else possess at the very least $500 of their own pay directly deposited in to the particular account.

The Lady is an expert in leading borrowers through typically the ins plus outs of having in inclusion to handling a individual loan. The Girl job offers recently been presented inside The Particular Cent Hoarder and Yahoo Financial. She contains a bachelor’s level inside journalism through Hampton University plus is centered in Polk Gulf, Florida. Presently There are usually a lot of trustworthy online lenders, yet these people compete alongside deceptive online lenders. The finest on-line lenders offer affordable prices (APRs of which best away at 36%) in inclusion to ample moment in purchase to pay off a mortgage.

Benefits And Cons Associated With Funds Advance Programs

- Unfavorable feedback complain about the failure in buy to obtain approved or getting borrowing benefits cancelled without a clear reason.

- In Case you’re accepted for the particular loan, you’ll receive loan paperwork to sign electronically.

- An Individual can acquire up in purchase to ₹10,500 instant credit rating for purchasing or bills along with interest-free repayment in fifteen or 30 days and nights.

- Consider whether the particular lender provides alternatives to be capable to assistance you via the particular borrowing procedure.

- Payactiv is usually an gained income access application of which permits consumers to get up to end upwards being capable to 50% in the course of a pay period after they’ve gained it.

- Cash advance apps usually are not payday loans; the particular exact same laws and regulations don’t control these people.

Because you’re borrowing through your self, an individual don’t want to satisfy credit rating specifications in purchase to consider out cash coming from life insurance policy. Failing to become able to repay typically the mortgage could mean your policy lapses, and it can get better curiosity fees and have got tax ramifications. A Person may use regarding a home equity loan or HELOC together with numerous banks, credit score unions, in inclusion to online lenders.

- A Person should also be skeptical associated with lenders of which try out to rush an individual through typically the application method, don’t obviously reveal their own costs in inclusion to phrases, or create guarantees of which noise as well good to be correct.

- The program approves customers’ loan within moments of doing your own software.

- When an individual wait around regarding the particular money advance in order to method outside an quick delivery cycle, a person will not really pay a payment during the particular 14-day free of charge trial.

- Whether Or Not you’re a college student, a company proprietor, or someone within want associated with crisis funds, these apps usually are designed to end upwards being in a position to supply a person along with typically the financial help an individual want inside real time.

- Several payday advance apps furthermore offer cost management tools to aid an individual monitor in add-on to handle your current investing or automatic savings equipment to aid a person create upwards your own emergency finance.

All associate in buy to the overall cost of their solutions, relieve associated with employ, and common applicability for everyday money administration needs. Revolut is usually a economic technology business that makes it easy to end upward being in a position to entry your own entire salary earlier — upward in buy to two days and nights prior to your own scheduled payday with a qualifying immediate down payment payer. Funds In Minutes is graded a single associated with the finest mortgage applications within Nigeria with consider to speedy in addition to superfast lending. A Person can acquire an immediate loan from this application in few moments regarding implementing. The Particular system includes a powerful plus large selection of goods in order to assist a person entry affordable financing for different requirements plus functions.

The Particular quick loan application gives a different variety of mortgage quantities, starting from as lower as N500 to up to N500,1000. Specta is an on-line lending program that will offers an individual loans of upward in buy to a few Million within a single purchase all within just a few minutes! Zero collateral, simply no paperwork, plus no check out in buy to any kind of workplace needed. It will be a single of typically the top something like 20 finest financial loan apps In Nigeria along with extremely lower curiosity in addition to superfast lending procedures. With Renmoney, you could apply for a regular financial loan to satisfy requirements just like developing your current little enterprise, renovating your own home, buying a new vehicle, having to pay rent, college charges, medical bills, and so on.

Plus maintain within mind of which “instant loans” typically appear as a income advance, which indicates they will may possibly just become obtainable to be in a position to customers along with a historical past associated with normal immediate deposits. Regarding instance, it may require primary debris coming from typically the similar source with respect to sixty days just before you’re entitled regarding advances. Along With therefore many financial loan applications in Of india, having funds whenever an individual require it offers in no way been easier or even more convenient.

Cash mortgage programs let you borrow funds whenever you’re in a pinch plus may’t hold out right up until the particular following salary. In Case an individual require a small amount of funds in purchase to include gas or an additional purchase, these varieties of programs can become a fast plus simple method in order to access funding. But it’s essential to end upwards being able to think about typically the price of making use of these sorts of applications in contrast in order to some other funding choices, just like a personal financial loan or maybe a credit card. Several applications carry out cost distinctive costs, like a registration charge or added costs regarding quicker financing. 1 of the particular best points concerning Dave will be of which it doesn’t examine your own credit score regarding money advances, so it won’t influence your own credit rating rating.

Programs Just Like Dave For Little Money Advancements In 2025

Also, the particular optionally available ideas and donations may add to the particular expense of typically the mortgage when you pick to contain these people. In add-on to become capable to cash advancements, the Brigit app provides built-in financial resources to become capable to aid a person spending budget, build credit, help save cash plus guard your own identity. ¹Early entry in buy to primary down payment money is dependent upon typically the timing associated with the submission associated with the transaction file through the particular payer.