Create certain in order to understand all of typically the needs necessary in buy to make sure a person fulfill all those skills just before signing upwards. In Order To select the finest funds advance applications, we all 1st narrowed our lookup to programs that will offer you instant money advance money, and also free of charge choices with simply no extra cash advance charges. We All after that chosen those of which don’t demand attention upon your money advance.

Financial Institutions

A Person can access your attained wages up in order to 2 times earlier which often helps prevent overdrafts and control your current spending. Same-day transactions in purchase to a Payactiv Visa® Cards usually are totally free with primary down payment. Normally, pay a $2.99 express fee to end up being capable to send funds to a non-Payactiv bank account or wait 1-3 business times in purchase to obtain your own funds fee-free. At Times, you simply need a little added money in buy to acquire an individual by means of until your following payday. These programs let an individual borrow cash to end up being capable to include unforeseen expenditures in inclusion to pay back it through your current next salary.

How Very Much May A Person Borrow On Earnin?

- This Specific could end upwards being especially beneficial if you’re attempting to be in a position to conserve cash or pay away from financial debt.

- Greatest associated with all, right today there are ways to be in a position to employ the application with ZERO costs in case you’re happy to hold out upwards to three business days to obtain your money.

- Related in purchase to applications like Venmo, Beem also gives money transactions thus an individual could deliver cash, cheques or presents to any person inside the particular United Declares.

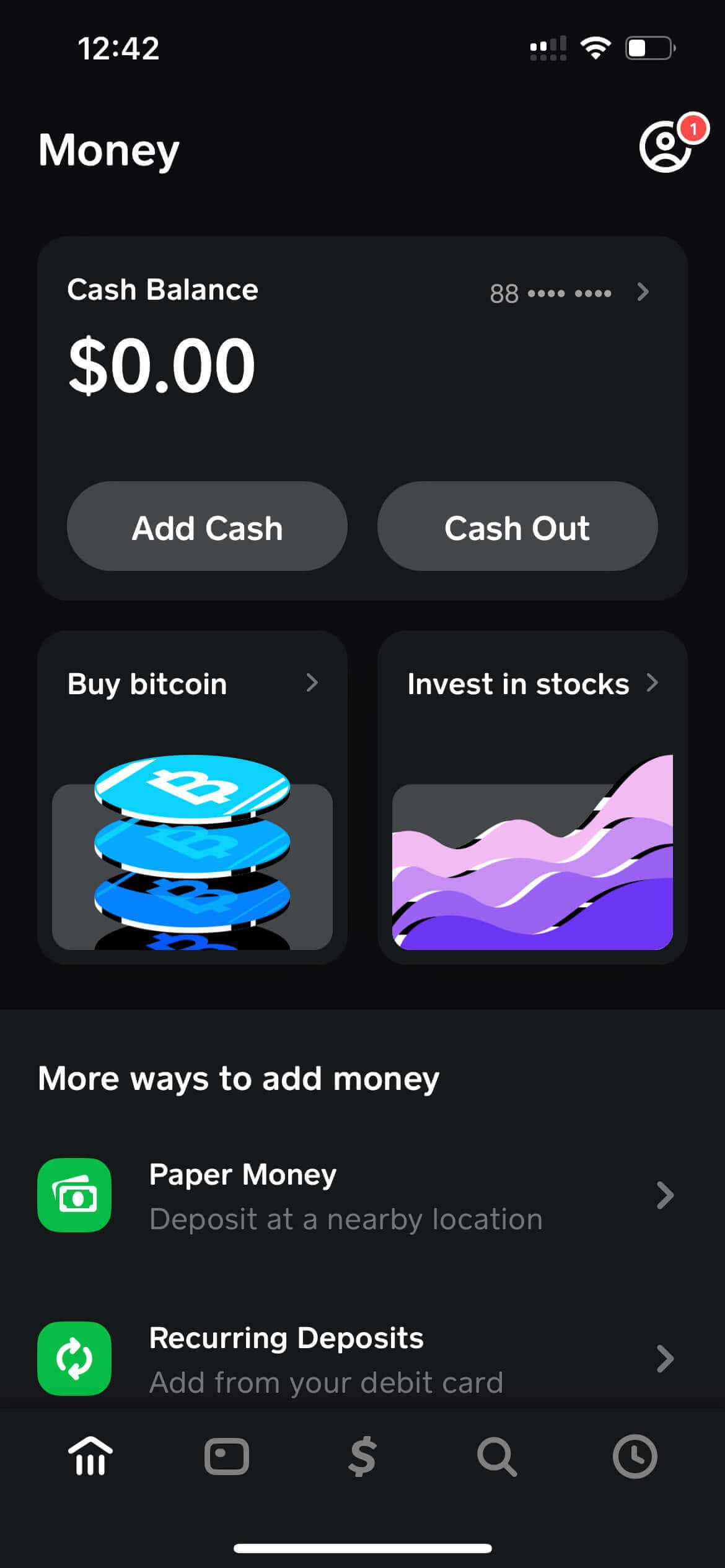

- Money App contains a “Cash App Borrow” feature that lets a few individuals borrow upward to become in a position to $200 – yet not all consumers are entitled.

Apps like EarnIn let gig employees faucet into their own gained wages together with simply no high costs. When a person don’t meet the criteria regarding funds advance apps because of to become in a position to abnormal job, Money App Borrow may be a solution. This feature, accessible to be capable to pick Money Application customers, enables you borrow upward to be in a position to $200 at a moment regarding a 5% payment. However, accessibility to be capable to typically the function depends upon your current state and some other conditions. Cleo is usually a great AI-powered budgeting and money advance application, offering 0% attention money advancements upwards in purchase to $250 for each pay period of time.

Best Cash Advance Programs

Most being approved users get their particular funds through Dork within one to become capable to 3 business days and nights. Convey charges can use in case you need an instant move plus transfers to some financial institutions may take extended. This FinTech business offers a no-fee looking at in addition to financial savings bank account to end up being capable to assist a person spend and conserve your current money more quickly.

A $100 money advance costs merely $9.99 in costs, producing Klover one of typically the lowest expense programs regarding borrowing $100. Let’s state you require access to a tiny additional cash, yet your own credit report offers taken several bumps and bruises – SeedFi may help. In Case you’re in typically the ‘poor’ to ‘fair’ selection and then a credit builder loan such as SeedFi’s Borrow & Grow Strategy may be an excellent device in buy to assist you access some money right apart. You can also create upwards savings for later AND create a good transaction history together with each on-time payment. If the borrowing limits of many money advancements isn’t suitable for your approaching costs, a financial loan by way of PockBox may become a much better solution.

Check Out The Particular Greatest Instant Borrow Cash Apps On-line: A Manual To Secure Money Advance Applications Or Legit Loan Apps

Keep informed and you’ll have typically the info an individual want to obtain typically the cash you need, any time an individual need all of them, inside a way of which functions with consider to a person. An Individual should constantly help to make certain that will you understand the charges and conditions associated with any type of mortgage prior to agree in order to borrow funds. Brigit offers instant funds improvements to be able to aid a person include bills, create crisis obligations, or merely accessibility the particular funds a person require in purchase to live your own existence. Just down load the particular software, swiftly link your bank accounts, in add-on to response a pair of concerns about your current boss. After That, any time a person need a tiny added cash, it’s yours with simply several shoes upon the Funds Out There function.

Summary Of Cash Advance Apps

Also even though most payday advance lenders have websites, funds advancements usually are only available via the particular app because of which can make it fast and successful. It prospects in order to impulsive selections, plus easily simplifies the particular process for consumers, meaning a whole lot more folks will borrow cash. Extremum are based upon financial worthiness in inclusion to financial institution bank account information, and many money advance programs, which include these 3, pay most borrowers far lower quantities. No Matter Which software finishes upwards about your own cell phone, become cautious in purchase to evaluation the particular conditions, conditions, and costs associated with the cash advance app a person choose.

- Encourage also includes a Thrive account of which starts accountholders away together with a $250 range associated with credit they may create up to end upwards being able to $1,500 as they will increase their own credit rating.

- Instead, they will leverage your own data, sending a person aimed adverts that will make Klover commissions when you simply click typically the backlinks in inclusion to create a obtain.

- Earnin will be a single associated with the particular greatest programs that allow an individual borrow funds immediately by facilitating earning all around America by income earners before payday.

- A Person may make use of a borrow funds app to become capable to obtain a funds advance, fee-free overdrafts, and the particular electronic comparative associated with a payday mortgage.

Solo Money

Consider them thoroughly to be in a position to determine when a cash or payday advance app will function for an individual. Though the advance payment can be high, Varo’s flat-rate pricing may become less difficult to become able to get around with respect to borrowers searching to be able to assess the advance’s cost upward entrance. Many cash advance apps cost fast-funding charges based upon the advance quantity and usually don’t publicize the level. Varo furthermore money all advancements instantly, which is a more common giving through banking institutions of which need borrowers to end upward being able to end up being checking accounts clients as in contrast to standalone money advance programs.

Carry Out All Money Advance Applications Job Along With Chime?

In Case a person open up a RoarCash account, regarding $1, the maximum increases and Turbo (instant payment) fees lower. If a person don’t have got RoarCash, you’ll pay $8.99 with respect to quick money of $90 or more how u borrow money from cash app. Along With no express fees, recommended tips, or curiosity, B9 fees just ONE flat fee – a month-to-month registration.

This Specific gets a person 0% APR money advances upward to be able to $250 in buy to assist an individual protect necessities in addition to surprises, merely utilize right here in inclusion to link your checking accounts (no month-to-month fee). As well as, you can get your own income upward to 2 days and nights early along with RoarMoney – plus easy techniques in order to borrow, save, spend, and make. EarnIn is usually a funds advance software of which allows you borrow upwards to end upward being able to $750 regarding your current gained wages just before payday with their Money Out characteristic. This borrowing restrict is significantly increased compared to many funds advance programs, plus unlike payday loans, there are usually simply no interest or funding costs to be in a position to use Cash Outs. MoneyLion gives no-fee funds advances up to $500, dependent upon your direct down payment action plus typically the services you indication up for.